BCMMetrics is the Right Choice for Insurance Business Continuity Management

BCMMetrics is the business continuity solution of choice for more than 10,000 organizational plans

Challenges in Insurance Business Continuity

Is your organization ready to handle the unexpected? Explore BCMMETRICS for insurance:

Regulations demand proof of resilience

Insurers must maintain documented business continuity plans and regular testing to stay compliant.

Challenges in Insurance Business Continuity

Is your organization ready to handle the unexpected? Explore BCMMETRICS for insurance:

Claims and customer service can’t stop

Policyholders expect uninterrupted support, even during outages, cyberattacks, or natural disasters.

Challenges in Insurance Business Continuity

Is your organization ready to handle the unexpected? Explore BCMMETRICS for insurance:

Critical systems must recover fast

Downtime in claims processing, underwriting, or customer databases can stall operations and erode trust.

Challenges in Insurance Business Continuity

Is your organization ready to handle the unexpected? Explore BCMMETRICS for insurance:

Coordinating response across locations is complex

With multiple offices and remote teams, insurers need a streamlined crisis response plan

How BCMMetrics Helps Insurance Businesses Resilience

Stay Compliant Without the Hassle

- Create clear, audit-ready documentation that meets state and federal regulations.

- Automate compliance tracking to keep up with changing requirements.

- Generate reports that demonstrate program effectiveness to regulators and stakeholders.

Keep Claims & Customer Service Running

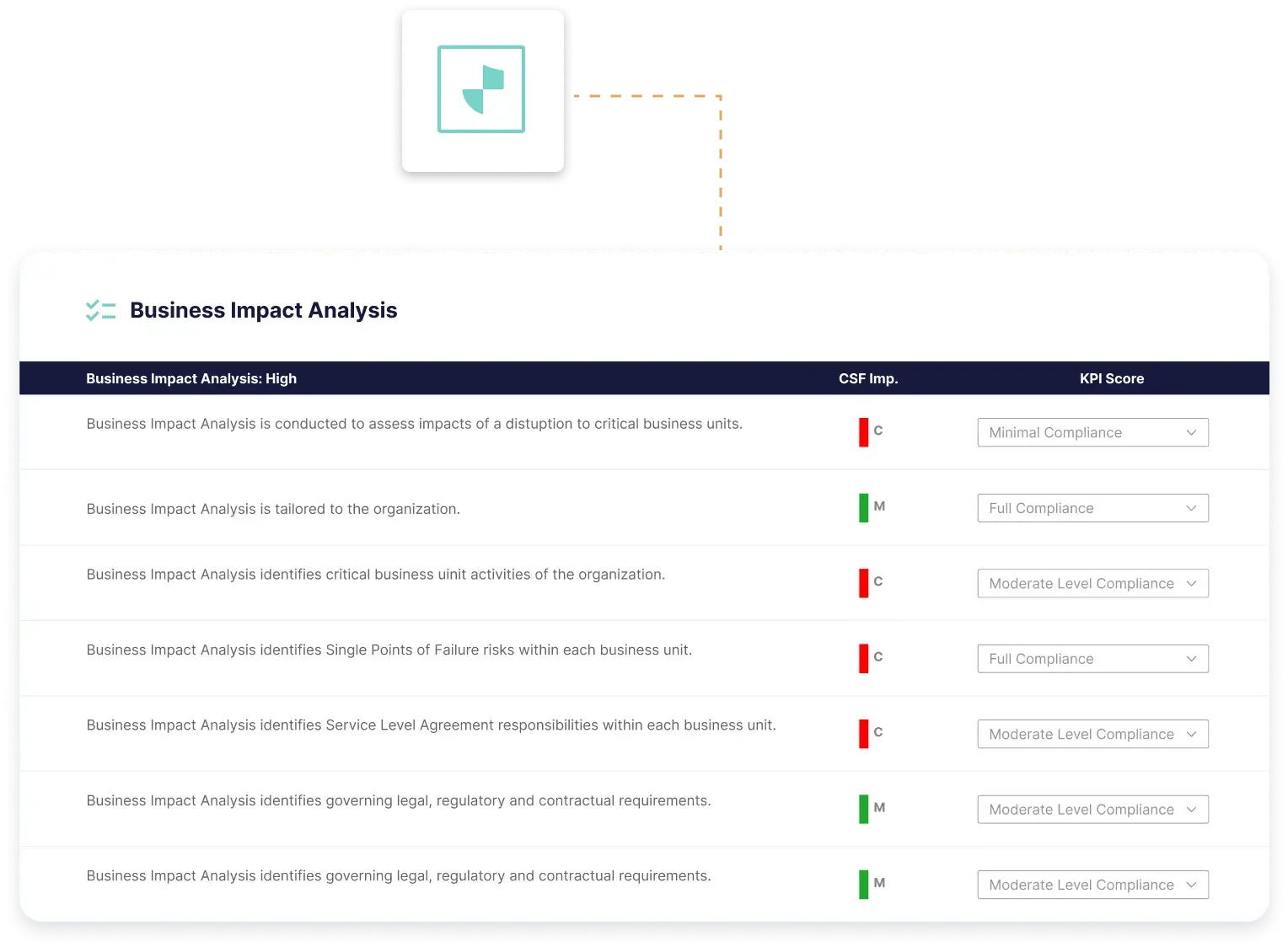

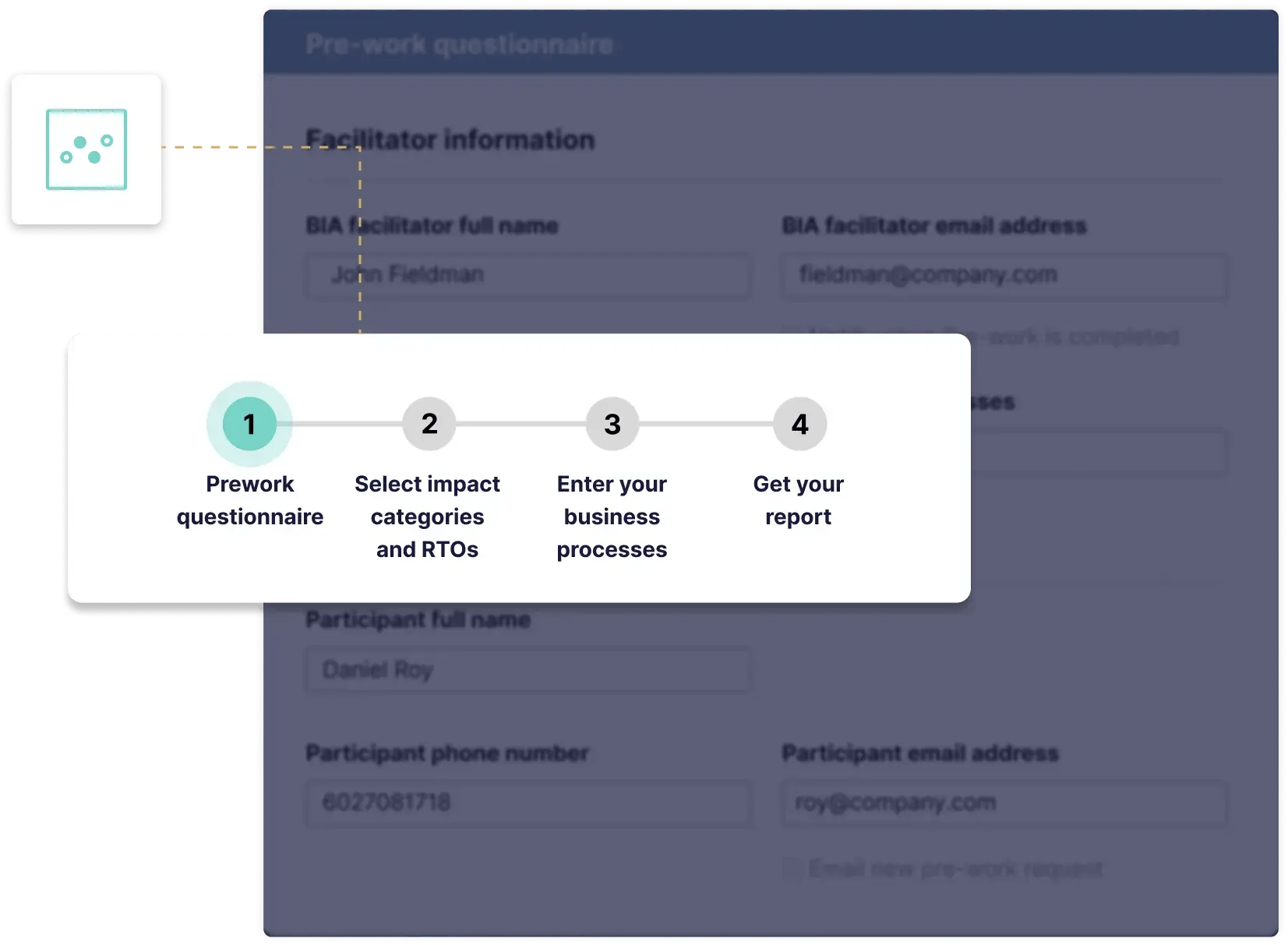

- Map essential business functions using proven BIA methods.

- Set recovery priorities for claims processing, customer service, and core systems.

- Maintain up-to-date contact lists and emergency procedures across all locations.

Protect Your Data & IT Systems

- Define recovery requirements for claims systems, customer databases, and policy records.

- Build practical IT recovery plans that work in real situations.

- Test system recovery procedures without disrupting daily operations.

Why choose BCMMetrics for Operational Resilience in Financial Institutions

Consolidate your processes

Be prepared for emergencies and disruptions

Reduce and mitigate risks

Make a big impact in short amounts of time

After using BCMMetrics, we understand what our most critical functions and applications are. That helps us design our recovery exercises so we can be sure we can recover those critical applications in a timely manner.

Senior Business Continuity Specialist, Shook, Hardy & Bacon

Michael and his team are continuity professionals. They've been around for a while–they know what they’re doing, what works and what doesn't work. They're also willing to listen to other community professionals to make improvements.

Business Continuity Manager, Atrium Health Wake Forest Baptist

It helps that BCMMetrics was created by continuity professionals, for continuity professionals. You have other solutions built by computer programmers that pulled information from a questionnaire and started tweaking it. They have not had the end-user experience to really make that program pop and be beneficial to the client.

Business Continuity Manager, Atrium Health Wake Forest Baptist

The team was fantastic in assisting us. In fact, they went above and beyond and ensuring that we could get done what we needed to do. They worked hard to ensure that we were happy and where we needed to be at the end.

Information Security Officer, Bank Holding Company

Creating a BIA Template for a Bank: A Step-By-Step

Because of their highly regulated nature, critical role in the economy, and attractiveness to cybercriminals, banks should be especially rigorous in performing BIAs.

Schedule a FREE Demo

Schedule your FREE demo today, and learn how BCMMetrics can increase your financial organization’s resilience by being prepared for, and responsive to, potential threats.